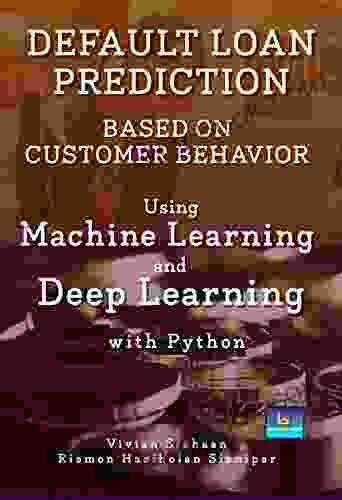

Default Loan Prediction Based On Customer Behavior Using Machine Learning And

Default loan prediction is a critical task for financial institutions. The ability to accurately predict which customers are likely to default on their loans can help banks and other lenders make better lending decisions, reduce their risk of loss, and improve their profitability.

4.8 out of 5

| Language | : | English |

| File size | : | 2502 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 197 pages |

| Lending | : | Enabled |

In recent years, machine learning and data mining techniques have been increasingly used to develop default loan prediction models. These techniques allow lenders to analyze large amounts of data, identify patterns and relationships, and build predictive models that can be used to assess the risk of default for individual customers.

There are a number of different machine learning and data mining techniques that can be used for default loan prediction. Some of the most commonly used techniques include:

- Logistic regression

- Decision trees

- Support vector machines

- Neural networks

- Ensemble methods

The choice of which machine learning technique to use for default loan prediction depends on a number of factors, including the size and quality of the data available, the desired level of accuracy, and the computational resources available.

In general, the more data that is available, the more complex the machine learning model that can be used. However, more complex models also require more computational resources to train and deploy.

The desired level of accuracy is also an important consideration. For some applications, a simple model that is able to achieve a high level of accuracy may be sufficient. However, for other applications, a more complex model that is able to achieve a very high level of accuracy may be necessary.

The computational resources available are also a factor to consider. Some machine learning techniques require significant computational resources to train and deploy, while others require very little.

Once a machine learning model has been developed, it can be used to score new customers and assess their risk of default. The score is a number that represents the probability that the customer will default on their loan.

Lenders can use the score to make lending decisions. For example, they may approve loans for customers with low scores and deny loans for customers with high scores.

Default loan prediction models can help lenders make better lending decisions, reduce their risk of loss, and improve their profitability. However, it is important to note that these models are not perfect. There is always a risk that a customer will default on their loan, even if they have a low score.

Lenders should therefore use default loan prediction models in conjunction with other information, such as the customer's credit history and financial situation, when making lending decisions.

Default loan prediction is a critical task for financial institutions. Machine learning and data mining techniques can be used to develop default loan prediction models that can help lenders make better lending decisions, reduce their risk of loss, and improve their profitability.

4.8 out of 5

| Language | : | English |

| File size | : | 2502 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 197 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Reader

Reader Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Bookmark

Bookmark Shelf

Shelf Foreword

Foreword Scroll

Scroll Tome

Tome Bestseller

Bestseller Narrative

Narrative Biography

Biography Encyclopedia

Encyclopedia Dictionary

Dictionary Thesaurus

Thesaurus Narrator

Narrator Librarian

Librarian Stacks

Stacks Periodicals

Periodicals Lending

Lending Reserve

Reserve Academic

Academic Journals

Journals Special Collections

Special Collections Interlibrary

Interlibrary Literacy

Literacy Study Group

Study Group Thesis

Thesis Dissertation

Dissertation Storytelling

Storytelling Reading List

Reading List Book Club

Book Club Theory

Theory Rainer Maria Rilke

Rainer Maria Rilke David P Redlawsk

David P Redlawsk Sara Herranz

Sara Herranz Randy Charles Epping

Randy Charles Epping John Braddock

John Braddock Megan Kreiner

Megan Kreiner Amali Gunasekera

Amali Gunasekera Lynn Michelsohn

Lynn Michelsohn Lance Marcum

Lance Marcum Chris Hall

Chris Hall Murray Grodner

Murray Grodner Michelle Richmond

Michelle Richmond Sally Dixon

Sally Dixon Matthew A Barsalou

Matthew A Barsalou Reginald Leon Green

Reginald Leon Green Pamela Hanlon

Pamela Hanlon Ann Lewin Benham

Ann Lewin Benham Hda Roberts

Hda Roberts Paul W Papa

Paul W Papa Mary Renault

Mary Renault

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Henry Wadsworth LongfellowAn Advanced Treatment Of Thoroughbred Class: A Comprehensive Guide

Henry Wadsworth LongfellowAn Advanced Treatment Of Thoroughbred Class: A Comprehensive Guide

Jonathan FranzenIndependent London East London Edition: A Stylish Stay in the Heart of...

Jonathan FranzenIndependent London East London Edition: A Stylish Stay in the Heart of... Samuel Taylor ColeridgeFollow ·17.5k

Samuel Taylor ColeridgeFollow ·17.5k Chase MorrisFollow ·6.2k

Chase MorrisFollow ·6.2k Derrick HughesFollow ·4.8k

Derrick HughesFollow ·4.8k Hugo CoxFollow ·19.4k

Hugo CoxFollow ·19.4k Marcel ProustFollow ·3.4k

Marcel ProustFollow ·3.4k Pablo NerudaFollow ·19.8k

Pablo NerudaFollow ·19.8k George R.R. MartinFollow ·5k

George R.R. MartinFollow ·5k Gerald BellFollow ·9.7k

Gerald BellFollow ·9.7k

Tom Hayes

Tom HayesSunset Baby Oberon: A Riveting Exploration of Modern...

In the realm of...

Barry Bryant

Barry BryantBefore Their Time: A Memoir of Loss and Hope for Parents...

Losing a child is a tragedy...

Johnny Turner

Johnny TurnerRhythmic Concepts: How to Become the Modern Drummer

In the ever-evolving...

Logan Cox

Logan CoxQualitology: Unlocking the Secrets of Qualitative...

Qualitative research is a...

Daniel Knight

Daniel KnightUnveiling the Secrets of the Lake of Darkness Novel: A...

A Journey into Darkness...

4.8 out of 5

| Language | : | English |

| File size | : | 2502 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 197 pages |

| Lending | : | Enabled |