Fundamentals of Institutional Asset Management: The Definitive Guide for Investment Professionals

Institutional asset management is a complex and ever-evolving field. As the global economy becomes increasingly interconnected, institutional investors are facing new challenges and opportunities. To succeed in this dynamic environment, investment professionals need a deep understanding of the fundamentals of institutional asset management.

This article provides a comprehensive overview of the fundamentals of institutional asset management. We will cover topics such as the different types of institutional investors, the investment process, and the challenges and opportunities facing institutional investors today.

Types of Institutional Investors

There are many different types of institutional investors, each with its own unique investment objectives and constraints. Some of the most common types of institutional investors include:

4 out of 5

| Language | : | English |

| File size | : | 16563 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 616 pages |

- Pension funds: Pension funds are retirement savings plans that are typically offered by employers to their employees. Pension funds are typically long-term investors, with a focus on preserving capital and generating income.

- Endowments and foundations: Endowments and foundations are non-profit organizations that are typically funded by donations from individuals or organizations. Endowments and foundations typically invest their assets in a mix of stocks, bonds, and other investments, with the goal of generating income to support their operations.

- Insurance companies: Insurance companies are financial institutions that provide insurance policies to individuals and businesses. Insurance companies typically invest their assets in a mix of stocks, bonds, and other investments, with the goal of generating income to meet their policy obligations.

- Sovereign wealth funds: Sovereign wealth funds are investment funds that are owned by governments. Sovereign wealth funds typically invest their assets in a mix of stocks, bonds, and other investments, with the goal of generating income to support government spending.

The Investment Process

The investment process is a systematic approach to making investment decisions. The investment process typically involves the following steps:

- Asset allocation: Asset allocation is the process of dividing an investment portfolio into different asset classes, such as stocks, bonds, and cash. Asset allocation is a critical step in the investment process, as it determines the overall risk and return profile of the portfolio.

- Security selection: Security selection is the process of selecting individual investments within each asset class. Security selection is a complex process that involves a variety of factors, such as the financial health of the company, the industry outlook, and the current market environment.

- Portfolio management: Portfolio management is the process of managing an investment portfolio over time. Portfolio management involves making adjustments to the portfolio as needed to meet the investor's objectives and constraints.

Challenges and Opportunities Facing Institutional Investors

Institutional investors are facing a number of challenges and opportunities in today's dynamic global economy. Some of the most significant challenges include:

- Low interest rates: Low interest rates have made it difficult for institutional investors to generate income. This has forced institutional investors to take on more risk in their portfolios, which could lead to losses in the event of a market downturn.

- Global economic uncertainty: The global economy is facing a number of uncertainties, such as the ongoing trade war between the United States and China. These uncertainties could lead to volatility in the financial markets, which could hurt institutional investors' returns.

- Regulation: Institutional investors are facing increasing regulation from governments around the world. This regulation can add to the cost of ng business and make it more difficult for institutional investors to generate returns.

Despite these challenges, institutional investors are also facing a number of opportunities. Some of the most significant opportunities include:

- New investment products: The development of new investment products, such as exchange-traded funds (ETFs) and hedge funds, has given institutional investors more options for diversifying their portfolios.

- Global investment opportunities: The globalization of the economy has created new investment opportunities for institutional investors. Institutional investors can now invest in a wider range of assets, including stocks, bonds, and commodities from around the world.

- Technology: Technology is transforming the institutional asset management industry. New technologies, such as artificial intelligence (AI) and blockchain, are making it easier for institutional investors to manage their portfolios and make better investment decisions.

Institutional asset management is a complex and ever-evolving field. Institutional investors are facing a number of challenges and opportunities in today's dynamic global economy. To succeed in this challenging environment, investment professionals need a deep understanding of the fundamentals of institutional asset management.

This article has provided a comprehensive overview of the fundamentals of institutional asset management. We have covered topics such as the different types of institutional investors, the investment process, and the challenges and opportunities facing institutional investors today. We hope that this article has been helpful in providing you with a better understanding of this important field.

4 out of 5

| Language | : | English |

| File size | : | 16563 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 616 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Novel

Novel Page

Page Chapter

Chapter Text

Text Genre

Genre Reader

Reader Paperback

Paperback Bookmark

Bookmark Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Autobiography

Autobiography Encyclopedia

Encyclopedia Narrator

Narrator Resolution

Resolution Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Stacks

Stacks Study

Study Research

Research Scholarly

Scholarly Lending

Lending Rare Books

Rare Books Interlibrary

Interlibrary Literacy

Literacy Thesis

Thesis Awards

Awards Reading List

Reading List Book Club

Book Club Theory

Theory Eric Berkowitz

Eric Berkowitz Bonny Becker

Bonny Becker Helen Stockton

Helen Stockton Vasco Duarte

Vasco Duarte Lois J Zachary

Lois J Zachary Roxanne Tully

Roxanne Tully Ken T Seth

Ken T Seth Elizabeth Green

Elizabeth Green Robert P Saldin

Robert P Saldin Tony Johnston

Tony Johnston Steven Hart

Steven Hart Josh Kosman

Josh Kosman William M Arkin

William M Arkin Fiona Mcgillivray

Fiona Mcgillivray Margaret Killjoy

Margaret Killjoy Sue Townsend

Sue Townsend Lee Strobel

Lee Strobel John Braddock

John Braddock Evelyn J Starr

Evelyn J Starr Kyla Duffy

Kyla Duffy

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Howard PowellA Comprehensive Exploration of the Enchanting World of Poetry for Children:...

Howard PowellA Comprehensive Exploration of the Enchanting World of Poetry for Children:... Carl WalkerFollow ·15k

Carl WalkerFollow ·15k Oscar BellFollow ·4.8k

Oscar BellFollow ·4.8k Billy FosterFollow ·17.3k

Billy FosterFollow ·17.3k Edgar HayesFollow ·13.1k

Edgar HayesFollow ·13.1k Eric HayesFollow ·2.9k

Eric HayesFollow ·2.9k Anton FosterFollow ·5.8k

Anton FosterFollow ·5.8k Andres CarterFollow ·16.1k

Andres CarterFollow ·16.1k Jerry WardFollow ·9.3k

Jerry WardFollow ·9.3k

Tom Hayes

Tom HayesSunset Baby Oberon: A Riveting Exploration of Modern...

In the realm of...

Barry Bryant

Barry BryantBefore Their Time: A Memoir of Loss and Hope for Parents...

Losing a child is a tragedy...

Johnny Turner

Johnny TurnerRhythmic Concepts: How to Become the Modern Drummer

In the ever-evolving...

Logan Cox

Logan CoxQualitology: Unlocking the Secrets of Qualitative...

Qualitative research is a...

Daniel Knight

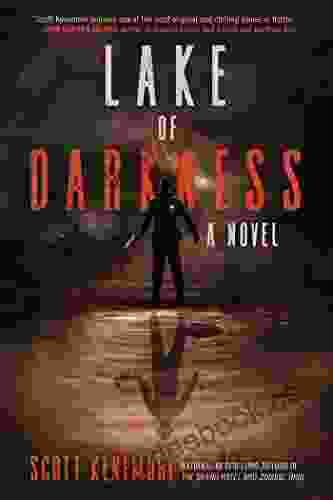

Daniel KnightUnveiling the Secrets of the Lake of Darkness Novel: A...

A Journey into Darkness...

4 out of 5

| Language | : | English |

| File size | : | 16563 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 616 pages |