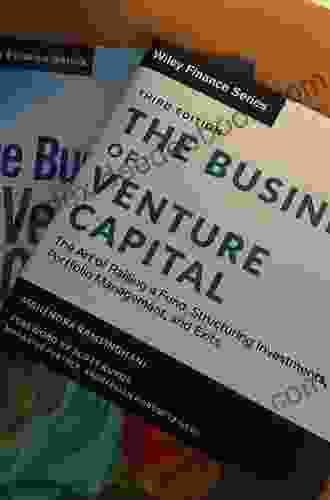

The Art of Raising Funds, Structuring Investments, Portfolio Management, and Exits

The venture capital and private equity industries are competitive and complex. To succeed, professionals in these fields need to master the art of raising funds, structuring investments, managing portfolios, and executing exits. This comprehensive guide will provide you with the knowledge and skills you need to excel in these critical areas.

The first step in the venture capital or private equity process is raising funds. This can be a challenging task, especially for new firms. There are a number of different ways to raise funds, including:

- Private placements: This is the most common way to raise funds for venture capital and private equity firms. Private placements involve selling securities to a limited number of accredited investors.

- Public offerings: Public offerings are another option for raising funds. However, this process is more complex and expensive than private placements.

- Government grants: Government grants are a source of funding for some venture capital and private equity firms. These grants are typically awarded to firms that are focused on specific industries or technologies.

When raising funds, it is important to develop a strong track record and a clear investment strategy. You should also be able to articulate your value proposition and demonstrate your ability to generate superior returns for investors.

4.6 out of 5

| Language | : | English |

| File size | : | 7658 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 485 pages |

| Lending | : | Enabled |

Once you have raised funds, you will need to structure your investments. This involves determining the type of investment, the amount of investment, and the terms of the investment. The structure of your investment will depend on a number of factors, including:

- The stage of the company you are investing in

- The industry of the company you are investing in

- The amount of risk you are willing to take

- The potential return on your investment

There are a number of different types of investments that venture capital and private equity firms can make. These include:

- Equity investments: Equity investments involve purchasing shares of a company's stock. Equity investments can be high-risk, but they also have the potential to generate high returns.

- Debt investments: Debt investments involve lending money to a company. Debt investments are typically less risky than equity investments, but they also have the potential to generate lower returns.

- Convertible investments: Convertible investments are hybrid investments that can be converted into equity or debt. Convertible investments provide investors with the potential for both upside and downside protection.

When structuring an investment, it is important to carefully consider the terms of the investment. These terms will include the purchase price, the maturity date, the interest rate, and the repayment schedule. You should also negotiate a strong legal agreement that protects your interests.

Once you have made a number of investments, you will need to manage your portfolio. This involves monitoring your investments, making sure that they are performing as expected, and taking corrective action when necessary. Portfolio management is a critical part of the venture capital and private equity process, and it can have a significant impact on your overall returns.

There are a number of different factors to consider when managing a portfolio. These include:

- The diversification of your portfolio

- The risk level of your portfolio

- The performance of your investments

- The market conditions

You should also develop a clear investment strategy and stick to it. This will help you to make informed decisions about your investments and avoid making emotional mistakes.

The final step in the venture capital or private equity process is the exit. This involves selling your investment and realizing a return on your investment. There are a number of different ways to exit an investment, including:

- Initial public offering (IPO): An IPO is a public offering of a company's stock. IPOs can be a very successful way to exit an investment, but they can also be risky.

- Sale to a strategic acquirer: A strategic acquirer is a company that buys another company to gain access to its products, services, or technology. Strategic acquisitions can be a good way to exit an investment quickly and with a high return.

- Sale to a financial buyer: A financial buyer is a company that buys other companies for the purpose of investing in them and selling them at a profit. Financial buyers can be a good way to exit an investment in a private company.

When exiting an investment, it is important to carefully consider the terms of the exit. These terms will include the sale price, the closing date, and the conditions of the sale. You should also negotiate a strong legal agreement that protects your interests.

The venture capital and private equity industries are complex and competitive. To succeed, professionals in these fields need to master the art of raising funds, structuring investments, managing portfolios, and executing exits. This comprehensive guide has provided you with the knowledge and skills you need to excel in these critical areas.

By following the advice in this guide, you can increase your chances of success in the venture capital and private equity industries.

4.6 out of 5

| Language | : | English |

| File size | : | 7658 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 485 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Genre

Genre Reader

Reader E-book

E-book Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Manuscript

Manuscript Scroll

Scroll Tome

Tome Bestseller

Bestseller Classics

Classics Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Dictionary

Dictionary Thesaurus

Thesaurus Narrator

Narrator Resolution

Resolution Catalog

Catalog Card Catalog

Card Catalog Borrowing

Borrowing Stacks

Stacks Study

Study Research

Research Lending

Lending Academic

Academic Special Collections

Special Collections Interlibrary

Interlibrary Dissertation

Dissertation Storytelling

Storytelling Awards

Awards Textbooks

Textbooks Philippe C Schmitter

Philippe C Schmitter Anita Brearton

Anita Brearton William Hooper

William Hooper Lauren K Denton

Lauren K Denton Jim Hoskins

Jim Hoskins Samra Sarfraz Khan

Samra Sarfraz Khan C D Muller

C D Muller Liane Moriarty

Liane Moriarty Thomas N Duening

Thomas N Duening Dorothy Baker

Dorothy Baker Leo Hunt

Leo Hunt Fairuz Nizam

Fairuz Nizam Nick Johnstone

Nick Johnstone Arnoldo Valle Levinson

Arnoldo Valle Levinson Robin Frederick

Robin Frederick Jessica R Patch

Jessica R Patch Ian Shapiro

Ian Shapiro Lincoln M Starnes

Lincoln M Starnes Hda Roberts

Hda Roberts Joe Pass

Joe Pass

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Corey HayesFollow ·5.2k

Corey HayesFollow ·5.2k Guillermo BlairFollow ·12.4k

Guillermo BlairFollow ·12.4k Martin CoxFollow ·3.1k

Martin CoxFollow ·3.1k Truman CapoteFollow ·5.2k

Truman CapoteFollow ·5.2k Bob CooperFollow ·18.7k

Bob CooperFollow ·18.7k Jorge AmadoFollow ·6.2k

Jorge AmadoFollow ·6.2k Billy FosterFollow ·17.3k

Billy FosterFollow ·17.3k W. Somerset MaughamFollow ·10.5k

W. Somerset MaughamFollow ·10.5k

Tom Hayes

Tom HayesSunset Baby Oberon: A Riveting Exploration of Modern...

In the realm of...

Barry Bryant

Barry BryantBefore Their Time: A Memoir of Loss and Hope for Parents...

Losing a child is a tragedy...

Johnny Turner

Johnny TurnerRhythmic Concepts: How to Become the Modern Drummer

In the ever-evolving...

Logan Cox

Logan CoxQualitology: Unlocking the Secrets of Qualitative...

Qualitative research is a...

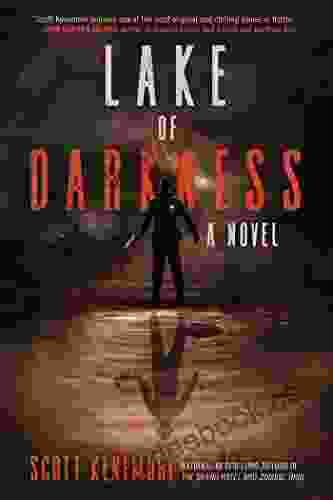

Daniel Knight

Daniel KnightUnveiling the Secrets of the Lake of Darkness Novel: A...

A Journey into Darkness...

4.6 out of 5

| Language | : | English |

| File size | : | 7658 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 485 pages |

| Lending | : | Enabled |